Вавада казино

Дата проверки зеркала:

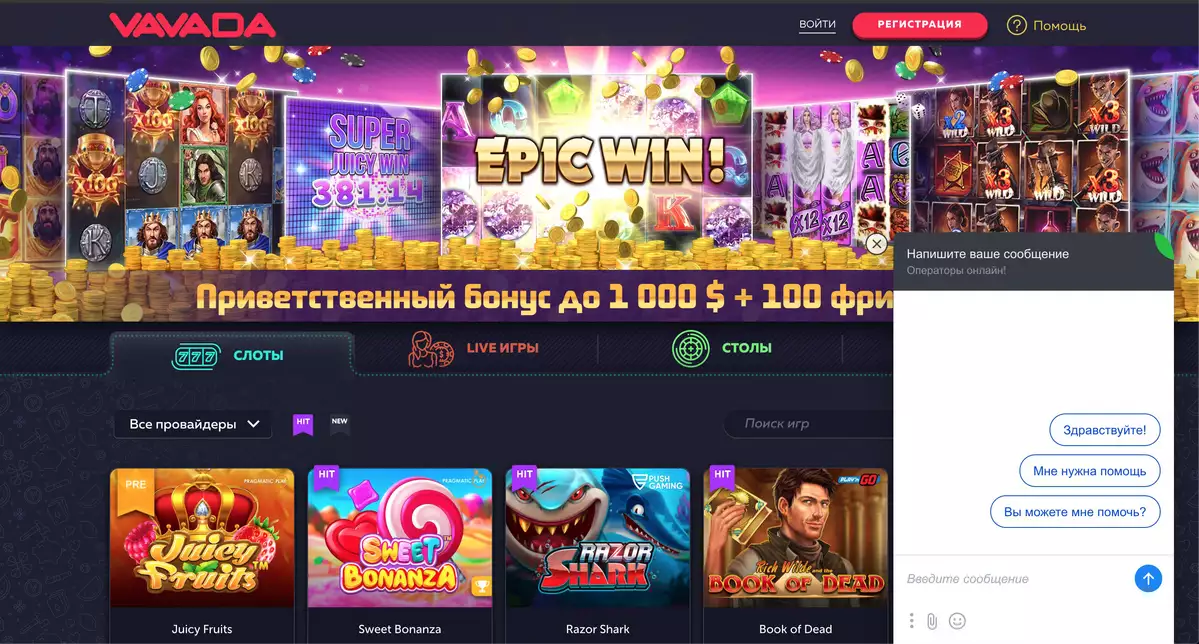

Открытие популярного игрового зала Vavada Casino произошло осенью 2017 года. С первого посещения официальный сайт Vavada завоевывал современным дизайном и удобной навигацией. Фишка заведения — яркая неоновая надпись с названием на темно-фиолетовом фоне, размещенная в верхней панели. Здесь же высвечивается никнейм клиента и быстрая кнопка пополнения баланса.

При клике на никнейм открывается личный кабинет. Для удобства он разделен на 5 вкладок:

- Профиль.

- Кошелек.

- Бонусы.

- Статус.

- Сообщения.

Пользователю предлагается полная настройка учетной записи, от заполнения анкеты и смены пароля до прохождения верификации, открытия дополнительных счетов и отслеживания текущего ранга.

Ниже размещен динамичный баннер, который приглашает поучаствовать в турнире и розыгрышах крупных призов, получить приветственный бонус.

Далее начинается знакомство гемблера с игротекой. Можно выбрать понравившуюся категорию: Слоты, Столы, Live Casino или турниры, либо посмотреть список популярных развлечений. Сейчас в топе находятся слоты Sweet Bonanza, Big Bamboo, The Dog House, Fruit Cocktail, Gates of Olympus.

Вавада официальный сайт сотрудничает с крупнейшими разработчиками софта: Amatic, BetSoft, Betgames, Microgaming, Blueprint, Slotmill, Red Tiger, Print Studios. Полный список размещен в футере. Здесь же можно ознакомиться с информацией про платежные методы, перейти и подписаться на социальные сети клуба, прочитать политику сообщества и правила ответственной игры.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🚩Лицензия | Кюрасао |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Регистрация личного кабинета на Vavada

Согласно положениям об использовании площадки, создать аккаунт разрешается всем совершеннолетним пользователям, которые ранее не регистрировались на домене. Возраст проверяется на всех этапах взаимодействия с сайтом Vavada: при заполнении анкеты новичка, получение персонального бонуса на День Рождения, снятии средств в особо крупных размерах.

Служба безопасности внимательно отслеживает и активность на странице. Если попытаться принять участие с двух профилей одновременно, велика вероятность блокировки учетной записи или аннулирования выигрыша.

Чтобы начать регистрацию онлайн, выполните следующие действия:

Зайдите на казино Вавада официальный сайт через браузер компьютера или смартфона.

Нажмите регистрационную кнопку и дождитесь загрузки анкеты.

Заполните поля с личными данными: имя, фамилию, дату рождения.

Выберите валюту: белорусские или российские рубли, гривны, канадские или американские доллары, тенге, евро, лиры, юани.

Поставьте галочки напротив соглашения с правилами и политикой конфиденциальности.

Дополнительную авторизацию с логином и паролем выполнять не нужно, вы сразу окажетесь в профиле. В личном кабинете подтвердите email и при желании пройдите верификацию. Это не обязательно, но значительно упростит дальнейший кэшаут и операции с валютой.

Вход в личный кабинетРабочее зеркало на сегодня

Вавада онлайн казино периодически перестает работать у гемблеров из стран СНГ. Основной домен блокируется Роскомнадзором, клиенты не могут войти в профиль и пользоваться функционалом ресурса.

Для обхода ограничений разработчики регулярно создают Vavada рабочее зеркало — альтернативный домен с измененным адресом. Внешний вид и навигация аналогичны официальному сайту Vavada, пользователь неограничен в регистрации, пополнении счета, активации поощрений и общении с технической службой. Также можно скачать приложение Вавада, оно будет переводить на рабочее зеркало.

Вход на Vavada зеркало осуществляется по ссылке. Ее можно найти несколькими способами:

- У технической службы в чате.

- У менеджеров в социальных сетях.

- На тематических форумах.

Будьте осторожны при самостоятельном поиске, на сторонних площадках скрываются мошенники, желающие заполучить личные данные посетителей заведения.

Самый быстрый вариант узнать Casino Vavada зеркало сейчас — написать оператору в чат. Специалист ответит в течение 3-5 минут, предоставит актуальных список всех доменов на сегодня.

Список рабочих зеркал Вавада

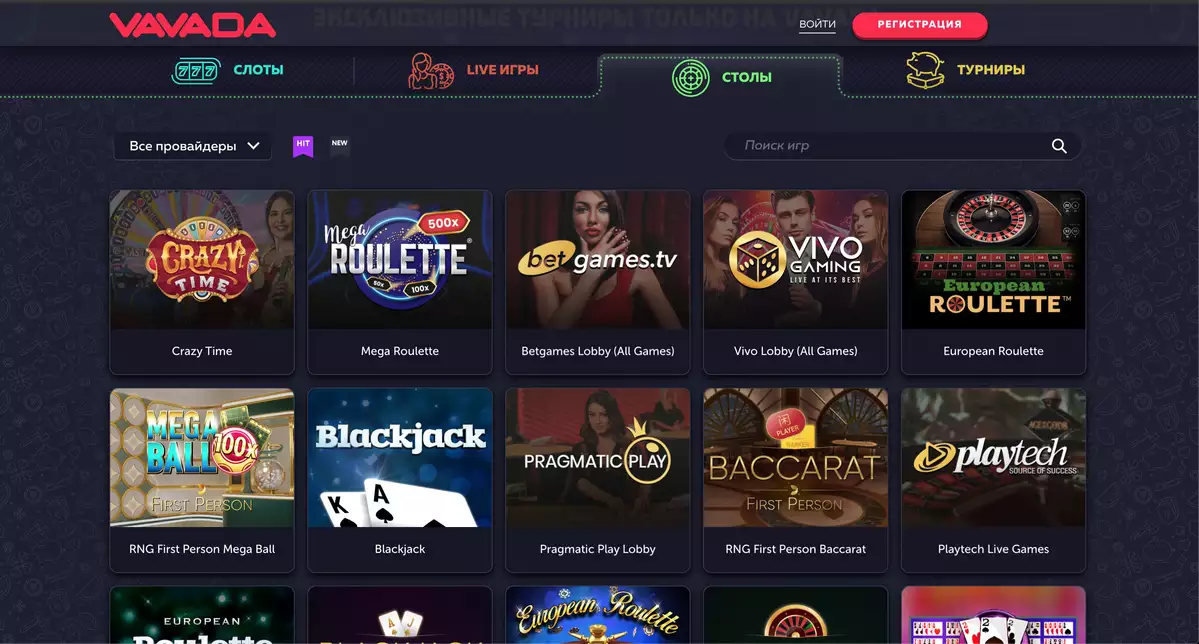

Live игры Вавада казино

Живые дилеры — одна из наиболее популярных категорий в казино Vavada. В отличие от классических слотов и настолок, где ставки делаются один на один с машиной, в лайве принимают участие только живые гемблеры и профессиональный ведущий.

На Вавада зеркало тоже перенесли этот раздел. Для удобства популярные разработчики выделены в лобби:

- Evolution Gaming — предлагает сыграть в жанры моментальных рулеток.

- Pragmatic Play — топ провайдер с моментальной баккарой и сик бо.

- Bergames — лидер по дуэлям костей.

- Vivo Gaming — производитель баккары, Teen Patti, Dragon Tiger, Blackjack в интересных тематиках.

Для старта достаточно: скачать приложение, подключиться к трансляции и сделать ставки. Перед вами окажется реальный ведущий, который будет общаться по видео, расскажет правила, даст подсказки и ответит на интересующие вопросы.

Игровые автоматы Live нельзя запустить в демонстрационном режиме. Перед подключением к трансляции участник видит небольшое превью с ведущим и может оценить обстановку в студии. Чтобы испытать все эмоции от режима живых дилеров, понадобится сделать денежную ставку.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

Турнир Вавада казино

Соревнования организовываются для уровней программы лояльности. Создатели подбирают оптимальную сложность по статусу и устанавливают соответствующие требования (минимальный размер хода, автоматы для игры, количество призовых мест.

Казино Вавада официальный сайт предлагает играть в турниры без отыгрыша. Независимо от размера полученного приза, ограничения касаются только максимального лимита вывода для конкретного статуса. Новичкам разрешается снимать до 1000 долларов в день, сохраняя анонимность, а ВИП пользователям открыт кэшаут размером 10 000 долларов и более.

Сейчас на площадке проводятся 3 типа состязаний:

- X-турнир — для новичков, в качестве игровой валюты используется основной баланс участника. Минимальное требование к ходу — 15 центов. Попробовать свои силы в турнире разрешается после определенной суммы затрат в обычных аппаратах. Призы раздают первой сотне в рейтинговой таблице. Общий фонд — 50 000 $.

- На фриспины — играется бесплатными вращениями. На выбор предлагается обширный список популярных слотов: Big Bamboo, Booty Bay, Cash Quest, Chaos Crew, Cubes 2, Deadly 5 и другие. Из них необходимо выбрать один и поднять как можно больший занос на фриспинах. Приз распределяется между 50 местами. Принять участие разрешается серебряным, золотым и платиновым гемблерам. Фонд — от 15 000 до 20 000 $.

- Кэш-турнир — играется виртуальными фишками. Турнирные слоты: Fat Drac, Fat Rabbit, Fire Hopper, Generous Jack, Mystery Mission - To The Moon. В случае неудачи разрешается докупать фишки не более двух раз за 6$. Выигрыш 20 000 $ установлен для всех рангов, распределяется между сотней счастливчиков.

Турниры проводятся и на Вавада официальный сайт рабочее зеркало.

Бонусы и промокоды

Программа лояльности распространяется на только что зарегистрированных и более опытных клиентов. Получить бонус можно за определенные действия, постоянную активность на главном сайте или в социальных сетях. Также действуют персональные предложения для особенно инициативных игроков.

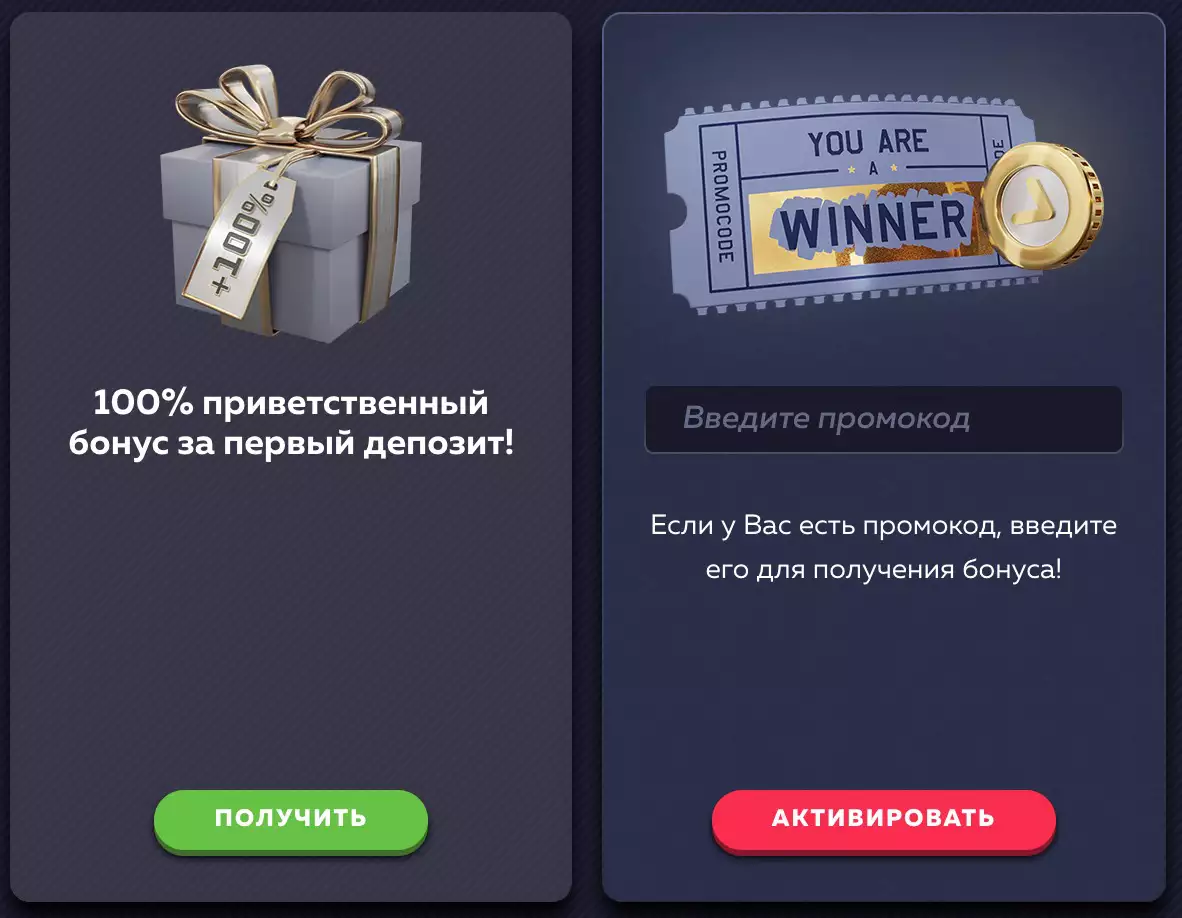

Приветственный пакет

После авторизации на Вавада зеркало или основном домене загляните в кабинет. В качестве поощрения за создания аккаунта администрация уже начислит 2 подарка:

- 100 бесплатных вращений — бездеп в аппарате Great Pigsby Megaways, который дает возможность сделать сто ходов без дополнительных затрат. Активируйте бонус в течение 14 дней с момента регистрации, чтобы он не аннулировался. После активации дается еще две недели на использование подарка и отыгрыш. Вейджер небольшой — х25, поэтому успешно вывести поощрение получится у всех.

- Удвоение пополнения — депозитный бустер при внесении 50-60 000 рублей одним платежом. Чтобы гарантировать честность использования презента, деньги сначала отправляются на отдельный баланс. Оттуда их можно беспрепятственно потратить на любимые симуляторы, а выигрыш потребуется выводить с вейджером х35.

Приветственные подарки выдаются один раз, поэтому не упустите свой шанс.

Кэшбэк

Тем, кто активен на ресурсе более месяца, предлагается регулярный возврат средств от проигранных ставок. Акция распространяется на гемблеров, чья статистика за месяц показывает больше убытков, чем прибыли. Джекпоты тоже считаются.

В качестве утешительного презента всем проигравшим приходит 10% от затрат. Коэффициент отыгрыша — х5.

Промокоды

Персональный бустер выдается за активность. Проверенные способы получить промокод:

- Участие в акциях.

- Постоянные взносы и затраты.

- Креативность в розыгрышах их социальных сетей клуба.

- День Рождения (выплачивается индивидуально, раз в год).

Напишите в чат поддержки и узнайте, если ли для вас промокод прямо сейчас. Подарок можно ввести во вкладке бонусов в компьютерной и мобильной версии заведения.

Если скачать Vavada casino мобильное приложение, открываются эксклюзивные промо и дополнительные поощрения. Ссылку для загрузки предоставит сотрудник по запросу.

Официальный сайтСлужба поддержки Vavada casino

Консультации клиентов проходят круглосуточно. Предлагается несколько способов связи с поддержкой:

- Online chat — самый быстрый из всех. Для создания диалога необходимо нажать на вопрос вверху экрана. Окно откроется в нижней части страницы. Выберите шаблон или напишите сообщение самостоятельно. Ожидание ответа зависит от времени суток и загруженности операторов. Ждать придется не больше 5-20 минут.

- Email — [email protected]. Отправьте запрос на электронную почту, если сотрудники в чате не смогли решить проблему. Рассмотрение письма занимает до нескольких дней.

- Skype — live:.cid.1f81fca32d3af0a6. Созвонитесь со специалистом по видео в удобное время и обсудите возникший вопрос. При живом общении операторы общаются на русском и английском языках.

Для быстрого созвона есть контактный номер — +1 404 382 0303. Стоимость соединения зависит от страны нахождения гемблера и оператора.

FAQ

Кому принадлежит казино Вавада?

Компанией владеет Макс Блэк — ранее гемблер-любитель и текущий миллионер. Макс увлекался азартными развлечениями и решил создать собственное в осенью 2017 года. Лицензия на размещений азартных симуляторов выдана государством Кюрасао.

В каком казино можно выиграть деньги?

Vavada славится честным игровым процессом и случайными результатами ставок. Выигрыш или проигрыш определяется рандомными алгоритмами, вмешательство третьих лиц в игру исключено. Дополнительно провайдерами гарантируется высокий RTP — это повышает шансы на выигрыш и при условии минимальных затрат. Наибольшая отдача в Let It Burn, Monster Superlanche, Hand of Anubis, Tombstone R.I.P., Retro Tapes, Who Wants to be a Millionaire Megaways, Scroll of Dead.

Как удалить аккаунт в Vavada?

Деактивация учетной записи происходит через техническую службу. Напишите в чат с просьбой удалить профиль временно или навсегда, причину указывать не обязательно. Администрация негативно относится к азартной зависимости и не принуждает посетителей тратить деньги.

Как найти Vavada?

Запустите удобную поисковую систему ПК или смартфона. Если официальный домен не высвечивается в результатах поиска, попробуйте найти зеркало на форумах, В Инстаграме, Вконтакте, Телеграме игрового зала.

Отзывы Вавада

-

Больше всего понравились классический покер и другие настолки. Не мог оторваться.

-

Регистрация заняла 2 минуты, быстренько подкорректировал анкету и приступил к слотам.

-

Были проблемы с выводом, поддержка решила вопрос за пару часов.

-

Сложный отыгрыш, а повышаться в уровне просто нереально. Рекомендую упростить систему.

-

По рекомендации друзей поучаствовала в турнире. Чудом оказалась на 97 месте и выиграла 100 баксов.